Investing through a bank means higher costs

On average, you pay 10x more in fees with a bank than you would with Lightyear. That’s money you could be investing, saving in an emergency fund, or using for everyday expenses. Over the course of a year, this could amount to hundreds of euros not working for your future.

Essentially, you're paying for convenience – the comfort of having all your financial services in one place: loans, daily banking, and investments. But is that convenience really worth the cost?

Why invest with Lightyear?

At Lightyear, you get low-cost and tax-efficient investing. Our mission is to grow long-term successful investors, which is why we keep our pricing as low as possible. We offer a smooth user experience and strive to provide the best service, continuously improving our offering based on user feedback.

Reasons to invest with Lightyear:

- Max €1/$1/£1 trading fee for stock purchases

- €0 ETF trading fee (note: fund provider fees may apply)

- Tax-efficient investing via the Investment Account system

- Over 6,000 stocks to explore

- 1.90% EUR interest through Savings

How to bring your portfolio to Lightyear?

If your current investments are held under the Investment Account system, you can transfer them to Lightyear without losing the tax benefits.

Steps to transfer your portfolio:

- Create an account on Lightyear.

- Ensure your current broker supports transfers and the instrument is available and tradable on the same exchange and currency on Lightyear.

- Lightyear doesn’t charge for incoming transfers, but your current broker might. If Lightyear doesn’t support the asset you want to transfer, email support@lightyear.com.

- In the mobile or web app, go to your profile and select “Transfer your portfolio”.

- Choose the account to which you want to transfer. Then select the asset you want to transfer. For stocks, we accept whole shares only and the transferable portfolio must be worth at least €/$/£1000. For bonds, you must transfer at least one bond, meaning the minimum value is the bond’s market price.

- Finally, select your broker so we can send you the instructions for submitting the transfer request from their platform.

Once that's done, just follow the guide to initiate the transfer with your current broker – after that, leave the rest to us! If your broker isn’t listed, select “Other”.

How much are you paying with different providers?

Let’s assume you regularly invest monthly across various markets. Here are some sample portfolios and a yearly cost comparison to show how fees grow as your portfolio expands.

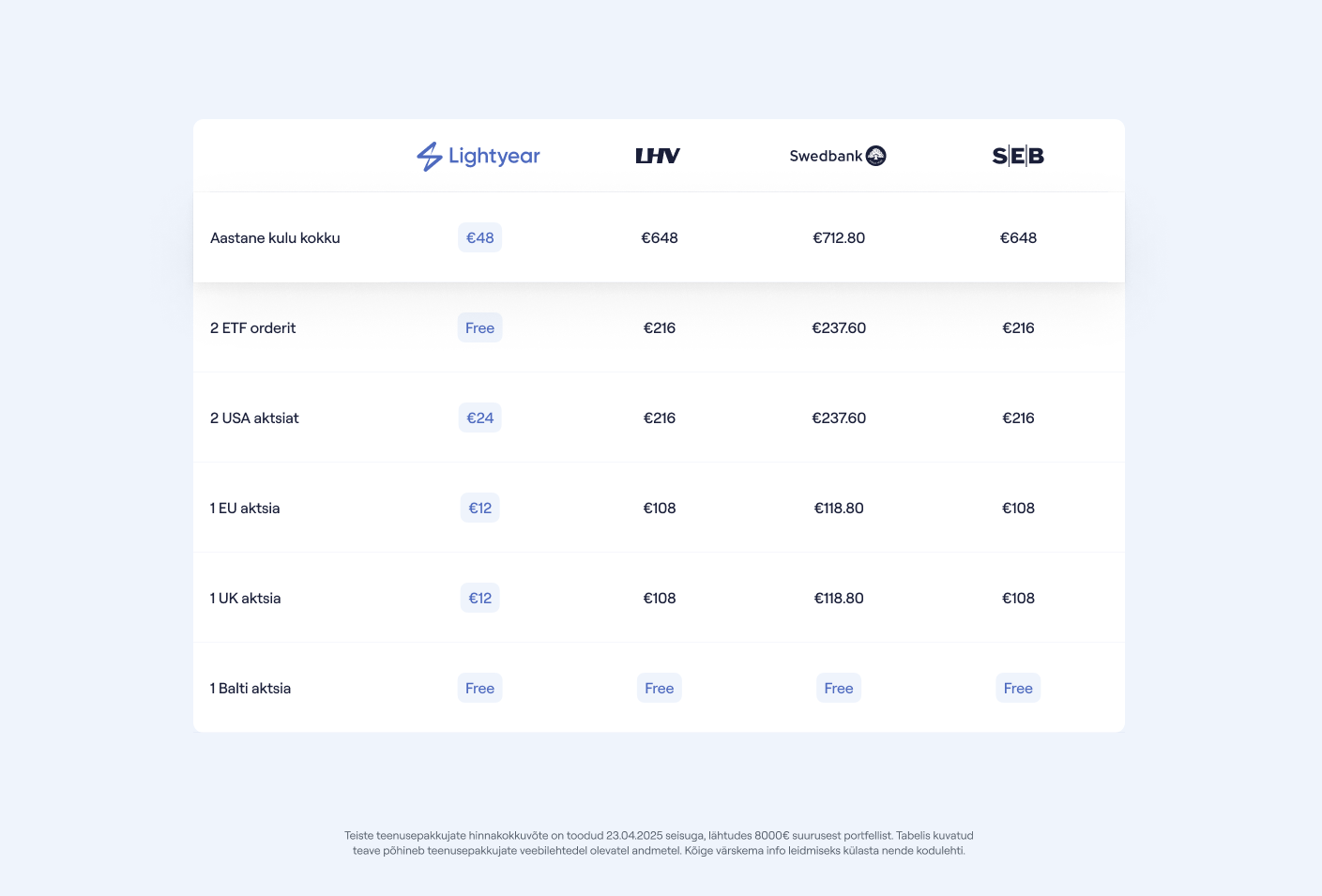

Investor A: You invest monthly in US, Baltic, European, UK stocks, and ETFs.

This example shows that long-term investing through a bank is significantly more expensive than through Lightyear. With Lightyear, the annual cost is only €48 while with Swedbank, Estonia’s largest bank, the same portfolio would cost €712.80 – nearly 15 times more.

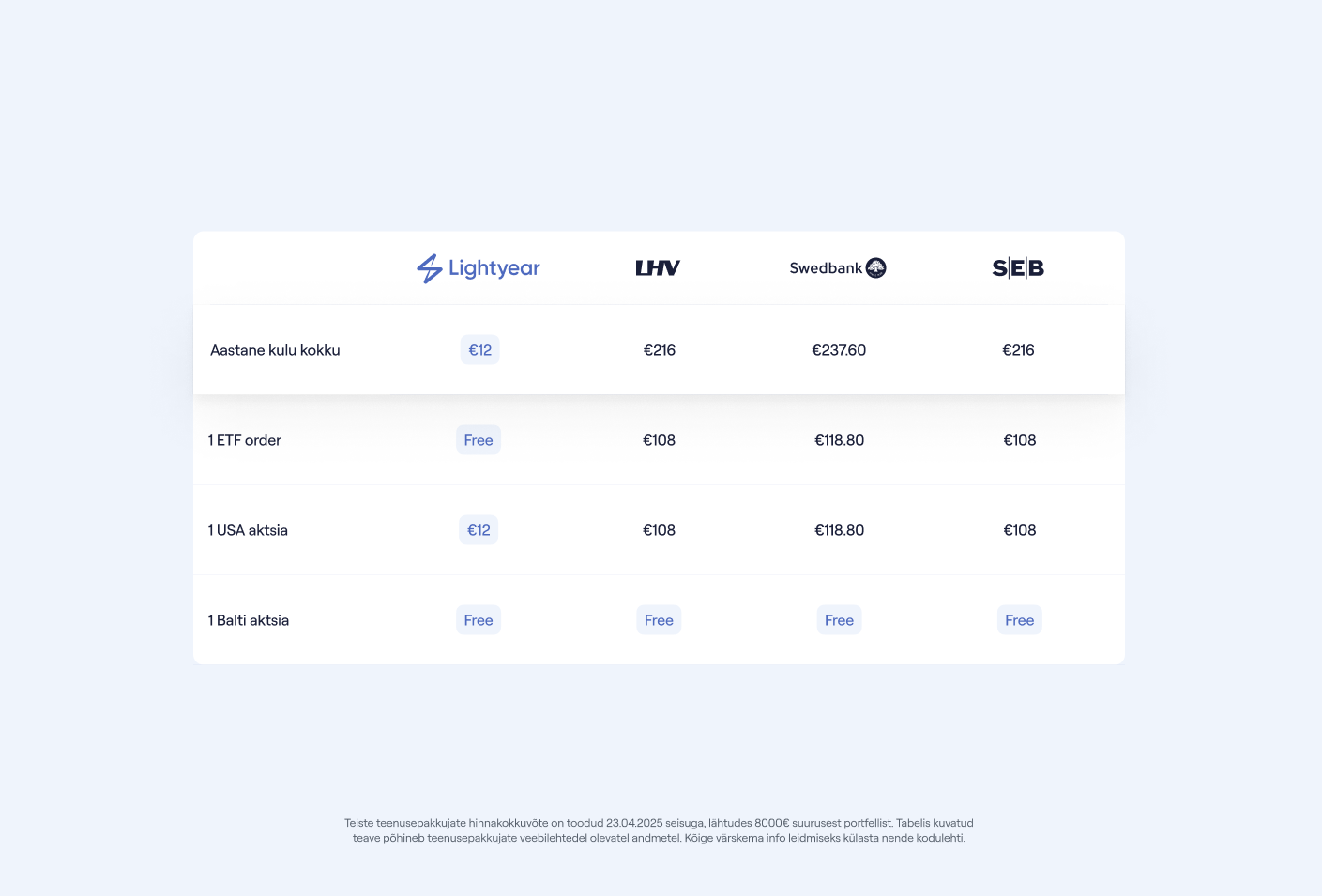

Investor B: You invest monthly in US and Baltic stocks and one ETF.

Even with fewer trades, Investor B would still face unreasonably high fees at the bank. Investing with Lightyear, the yearly cost would be €12 per year while in the bank the same cost would be over €200 per year.

To simplify the comparison, we’ve excluded account maintenance fees (free at Lightyear) and currency conversion fees. Banks often don’t clearly disclose their FX fees, but the average is around 1%. Lightyear’s FX fee is 0.35%.

Why is Lightyear more affordable?

The banking business model is fundamentally different from Lightyear’s. Banks primarily make money by gathering deposits and issuing loans – investing is not their core focus. Estonian banks are built for a local market of about 1 million people, while Lightyear operates in 22 markets across Europe, building a product for 500 million Europeans. This means we can scale our technology, lower our costs, and deliver a more affordable service with equal (or better) quality.