Let’s be honest: self-custody isn’t for everyone.

For some, holding Bitcoin in a hardware wallet is non-negotiable. Not your keys, not your coins, as the saying goes. But for investors who’ve never touched Bitcoin, and are looking to gain some exposure with minimal hassle, self-custody might be overkill. Buying a wallet. Backing up a seed phrase. Signing up to a crypto exchange. It’s not exactly plug-and-play.

For investors who recognise the value of Bitcoin and want to invest some percentage of their portfolio in this digital asset, there are now several very convenient ways to do so.

In this post, we’ll explore how you can invest in Bitcoin without touching a crypto exchange, what the deal is with ETPs (that’s Exchange Traded Products), and take a closer look at one of the most practical options available today: the WisdomTree Physical Bitcoin ETN.

Quick refresher: ETP, ETF, ETC, ETN… what?

Let’s first untangle some acronyms. Exchange Traded Products (ETPs) are a family of investment instruments that trade on stock exchanges - much like shares. They're designed to track the price of an underlying asset.

Here’s how the sub-categories break down:

- ETF (Exchange Traded Fund): Typically used for baskets of assets, like stock indices (e.g. iShares €CSPX tracking the S&P500) or sector-based themes (VanEck’s €DFEN for the defence industry). Most are UCITS-compliant, which makes them a mainstay in European investment portfolios.

- ETC (Exchange Traded Commodity): Tracks a single commodity, like gold or oil (e.g. iShares €PPFB, which tracks the price of physical gold). These are technically structured as debt instruments.

- ETN (Exchange Traded Note): Similar to ETCs but can track more exotic assets - including cryptocurrencies. ETNs often involve some form of credit risk, as they are backed by an issuer rather than direct ownership.

Together, these make up the broader ETP landscape. Bitcoin, being a single digital asset, is usually offered through an ETN or ETC structure, depending on jurisdiction and legal wrapper.

Why people are talking about Bitcoin ETPs right now

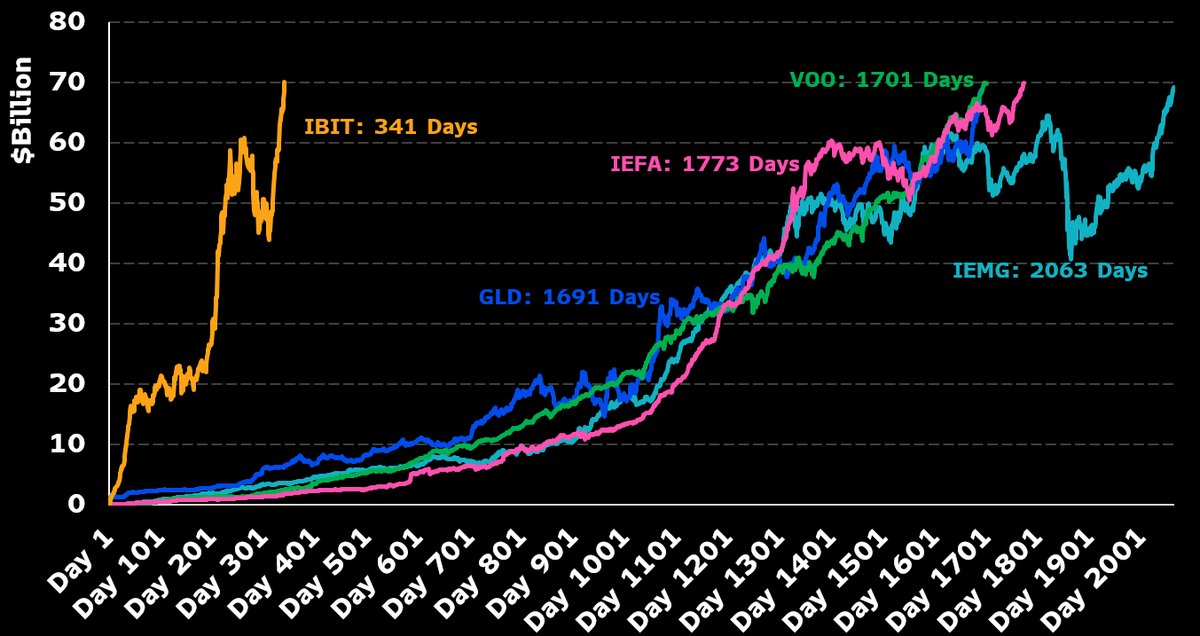

In early 2024, BlackRock made headlines with the launch of its iShares Bitcoin Trust - the first spot Bitcoin ETF in the U.S. It became the fastest-growing ETF in history, surpassing $70 billion in assets in under a year. For many investors, this marked a tipping point: if BlackRock is in, Bitcoin’s not going away.

But here’s the catch: BlackRock’s Bitcoin ETF isn’t available to European retail investors. Under UCITS rules, ETFs in Europe must meet certain diversification requirements. After all, an ETF is intended to offer exposure to a basket of assets. A product that tracks a single asset - like Bitcoin - doesn’t meet those diversification thresholds, and so can’t be marketed as a UCITS ETF.

That means no spot Bitcoin ETFs (at least for now) in Europe under the UCITS label. But don’t worry; we still have a viable alternative.

If you’re looking for simple, regulated Bitcoin exposure through your investment account, there’s a product that gets you very close: the WisdomTree Physical Bitcoin ETN - available today on Lightyear.

Spotlight on WisdomTree Physical Bitcoin (€WBIT)

The WisdomTree Physical Bitcoin ETN (tickers: $BTCW / €WBIT) is one of the most established ways for European investors to gain Bitcoin exposure without needing a crypto wallet.

Let’s unpack what it is and how it works.

⚠️ Before we dive in

Just a quick heads‑up: nothing below is investment advice or a personal recommendation.

Bitcoin ETNs are complex investment products, and they won’t be right for everyone - especially if you’re new to investing. Make sure you understand how these products work and the risks involved (like volatility and issuer risk) before deciding whether they fit into your portfolio.

✅ Physically backed with actual Bitcoin

Unlike some crypto-linked products that simply mirror Bitcoin’s price with derivatives, this ETN is physically backed. That means every share represents a real claim on Bitcoin held in custody.

WisdomTree holds the actual Bitcoin in cold storage - a secure, offline environment protected by institutional-grade custodians like Swissquote Bank and Coinbase Custody. These aren’t fly-by-night names. They’re regulated, insured, and operate at the highest standards of crypto security.

🔁 Daily pricing and transparent tracking

The ETN’s value is tied to the Compass Crypto Reference Index – Bitcoin, which aggregates prices across several reputable exchanges. Each share reflects a specific entitlement to Bitcoin, adjusted daily for fees (0.15% management fee, as of 16th July 2025).

The price updates daily to reflect real-time changes in the market - giving you a clean, trackable exposure to Bitcoin’s movements, all from within your investment account.

🌍 Traded on major EU exchanges

The WisdomTree Bitcoin ETN is listed on:

- Xetra, in EUR (€WBIT) - this is the listing we have available on Lightyear

- Euronext, in USD ($BTCW) and EUR (€WBTC)

- SIX Swiss Exchange, in CHF (₣BTCW)

- London Stock Exchange, in USD ($BTCW) and GBP (£WXBT)

Customers who reside in the EU can access the WisdomTree Bitcoin ETC today, without any special steps.

📦 Could form part of a diversified portfolio

Because it’s an ETP, the €WBIT ETN can sit alongside your ETFs, stocks, and other traditional investments. No need to learn a new platform. No seed phrases. No panic when you forget which USB stick held your keys.

You’re simply investing in a listed security - one that happens to be backed by Bitcoin.

Caveats and considerations

This might not be the right fit for everyone, of course. A few things to keep in mind:

- Market risk: Bitcoin is famously volatile. The value of the ETN will rise and fall with the price of Bitcoin - sometimes dramatically.

- Issuer risk: ETNs are technically debt instruments. You’re exposed to the creditworthiness of the issuer (WisdomTree Issuer X Limited), although the physical backing helps mitigate this.

- Currency risk: The ETN listing on Lightyear is denominated in EUR. If your portfolio is in another currency, fluctuations in FX rates can affect your returns.

And finally: this isn’t the same as owning Bitcoin directly. If you’re a believer in the crypto ethos of self-custody, decentralisation, and sovereign ownership, then consider setting up a proper wallet.

So - should you invest in a Bitcoin ETN?

If you’re curious about Bitcoin but not ready for private keys and seed phrases, a product like WisdomTree’s WBIT is a compelling option. It wraps Bitcoin in a format you already understand, with regulated custodians and daily liquidity. Whether it’s right for you will depend on your own circumstances, experience and risk tolerance.

No passwords to forget. No wallets to misplace. Just exposure to Bitcoin - made simple.

Alternatively if you’re looking to gain exposure to the wider Bitcoin ecosystem, not just the asset itself, there are ETFs on Lightyear which can help you to do just that. The Invesco CoinShares Global Blockchain ETF (£BCHS) invests in around 50 companies that participate in the space, including miners, Bitcoin treasuries, and crypto exchanges.

As always, consider how it fits within your broader investment goals, your risk tolerance, and your views on crypto in general. But for many investors in the EU, this may be the easiest - and most practical - way to dip a toe into digital assets.