Savings interest calculator

Your situation

Achieving your goal

Your savings projection

This calculation assumes you put money in at the end of each month, that the rate of return remains constant, and that interest compounds monthly. If you don’t make regular deposits, or your rate of return isn’t guaranteed, enter estimates to get a rough answer. Forecasts are not a reliable indicator of future performance.

Selecting Lightyear Savings assumes investment into money market fund yielding today's rate. The 1-day yield changes slightly day-to-day and significantly when there is a change to the Central Bank rate. For simplicity, this calculation assumes the 1-day yield does not change. Make sure to read and understand risks related to money market funds before investing, explained in our Risk Disclosure.

How to use our compound interest calculator

If you’re saving or investing for the future, our savings interest calculator can help you to visualise when you may hit your financial goals - and how to get there quicker if you want to. Read on for all you need to know about how interest and compound interest work, and why they matter to UK investors.

First, let's take a look at how to use our savings interest calculator to leverage compound interest, helping you to meet your savings goals as quickly as possible:

- Enter your savings goal and choose your currency (£ / $ / €)

- Enter the amount you want to deposit (i.e. how much you’ve already saved)

- Enter the amount you’ll save or invest monthly

- Enter your expected interest rate as an APY (i.e. the rate offered by your savings account, or the rate at which you anticipate your investments to grow)

You’ll see the potential return including compound interest, and when you’ll achieve your saving or investment target. You can select different investment and savings options from the dropdown list, or change the initial or monthly deposit amounts, to see how quickly you may hit your savings goals in different scenarios.

What is interest? What affects interest rates?

Interest is the percentage amount paid by a bank or financial service provider, when you save money with them. Your savings account interest rate is set by your account provider, and can vary depending on changes in the market, and on the provider’s own policies.

Some accounts may track external indicators like the Bank of England base rate, for example - but generally, interest rates are set to reflect broad market trends and confidence, macro economic factors and more.

How often will I be paid interest?

Different banks and financial service providers set their own timetables for paying interest. This is important when it comes to compounding - which we’ll look at later. Some accounts may pay interest daily, monthly, quarterly or annually for example. Accounts which pay interest more frequently can be beneficial when it comes to compound gains - more on that next.

Lightyear pays interest on uninvested cash balances on the 1st of every month.

What is compound interest?

Compound interest is interest on interest.

This matters because interest is calculated as a percentage of the amount saved or held in your account. The more you have, the more you can earn.

To give a very simplistic overview, if you save 100 pounds, and earn 5 extra pounds interest, the balance in your account will be 105 pounds. When you’re next paid interest, the amount you earn will be calculated based on 105 pounds, meaning you'll see a higher overall return compared to interest earned on a deposit of 100 pounds. We’ll cover a real life example a little later so you can visualise how this plays out - and why it’s great for hitting your financial goals as soon as possible.

Why should I care about compound interest?

Compound interest is a powerful tool when it comes to growing your savings and investments. In effect it means that a pound saved today is worth more to you than a pound you might save in ten years time. Any returns made on investments can have a snowballing effect through compound interest, as you earn more and more interest over time, based on the compounding effect.

Ultimately, using compounding to grow your wealth can mean you hit your financial goals faster, and that it costs you less in the end to achieve the target amounts you’re aiming for. Saving or investing little and often can be more impactful than holding out and putting off working towards your savings goals until later.

How long will it take me to save my target amount? A worked example

Let’s take a look at how this works in real terms. Let’s say I choose to invest 1000€ today, and get a rate of return of 4.5% APY annually. The interest I would earn over 5 years - assuming I never add another penny, and the interest rate remains flat - looks like this:

Year 1: 45.00 EUR

Year 2: 47.03 EUR

Year 3: 49.14 EUR

Year 4: 51.35 EUR

Year 5: 53.66 EUR

As you can see, the amount of interest earned grows steadily thanks to compounding. After 5 years, your deposit in this example is worth 1246.18€ - all with no additional deposits.

To hit your financial goals faster, you could look for an account which offers a better rate or opt to add money on a more regular basis. If you’re willing to accept a higher level of risk, you might look for alternative investment options with higher potential returns.

Interested in what happens if you continue to pay in on a regular basis? Let’s take that calculation again - depositing 1000€ into an account which pays 4.5% interest annually. Instead of leaving your account untouched, let’s look at what happens if you pay in 50€ a month over 5 years. We’ve assumed in these calculations that the rate of return is steady at 4.5%. Firstly, here’s how the interest now compounds:

Year 1: 57.28 EUR

Year 2: 86.85 EUR

Year 3: 117.76 EUR

Year 4: 150.07 EUR

Year 5: 183.81 EUR

Over the 5 years, you’ve added 3,000€, at a rate of 600€ a year. By the end of year 5, including your initial 1,000€ investment, your pot is now worth 4595.77€. Add more every month, target a higher rate of returns, or leave your nestegg for longer, to let your money grow even more.

How the monthly savings interest calculator works: the compound interest formula

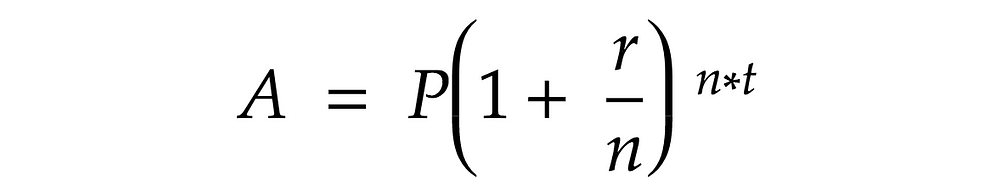

Wondering about the maths that sits behind compound interest? Our savings interest calculator is powered by the compound interest formula:

In this formula:

A = what your investment will ultimately be worth

P = the principal; the initial amount you’ve invested in savings

r = the annual savings interest rate of your account, expressed as a decimal

n = number of times interest is paid out; often monthly, quarterly or annually

t = the number of years you leave your investment to compound

Of course, it gets a little more complex when you add monthly contributions into the mix! But our calculator will account for these too, and calculate compounding growth on any contributions you make.

Your options for meeting your savings goals

So, how can you use compounding to meet your savings goals? Here there’s no right or wrong answer, it will all depend on your timelines and your tolerance of risk.

You could choose to deposit your money into an interest earning account. This is relatively low risk. Banks and similar non-bank providers offer accounts in which your principal is protected, often by both the bank and government backed schemes like FSCS. The potential returns here are variable based on changing rates, and may not be the very highest earning options out there.

An alternative is to invest in stocks or funds, in which the returns you get are based on asset performance. Here you may find higher potential returns, but you will need to research your options carefully as your capital is at risk. That means that if an asset does very badly, the value of your investment may go down rather than up.

For many people, having a balance of savings and investments including riskier options like shares and funds offers a diverse portfolio which spreads risk and can offer good return potential. If you’re considering this approach, check out the Lightyear personal account - this offers up to 4.50% interest on uninvested cash, as well as a variety of investment options including: