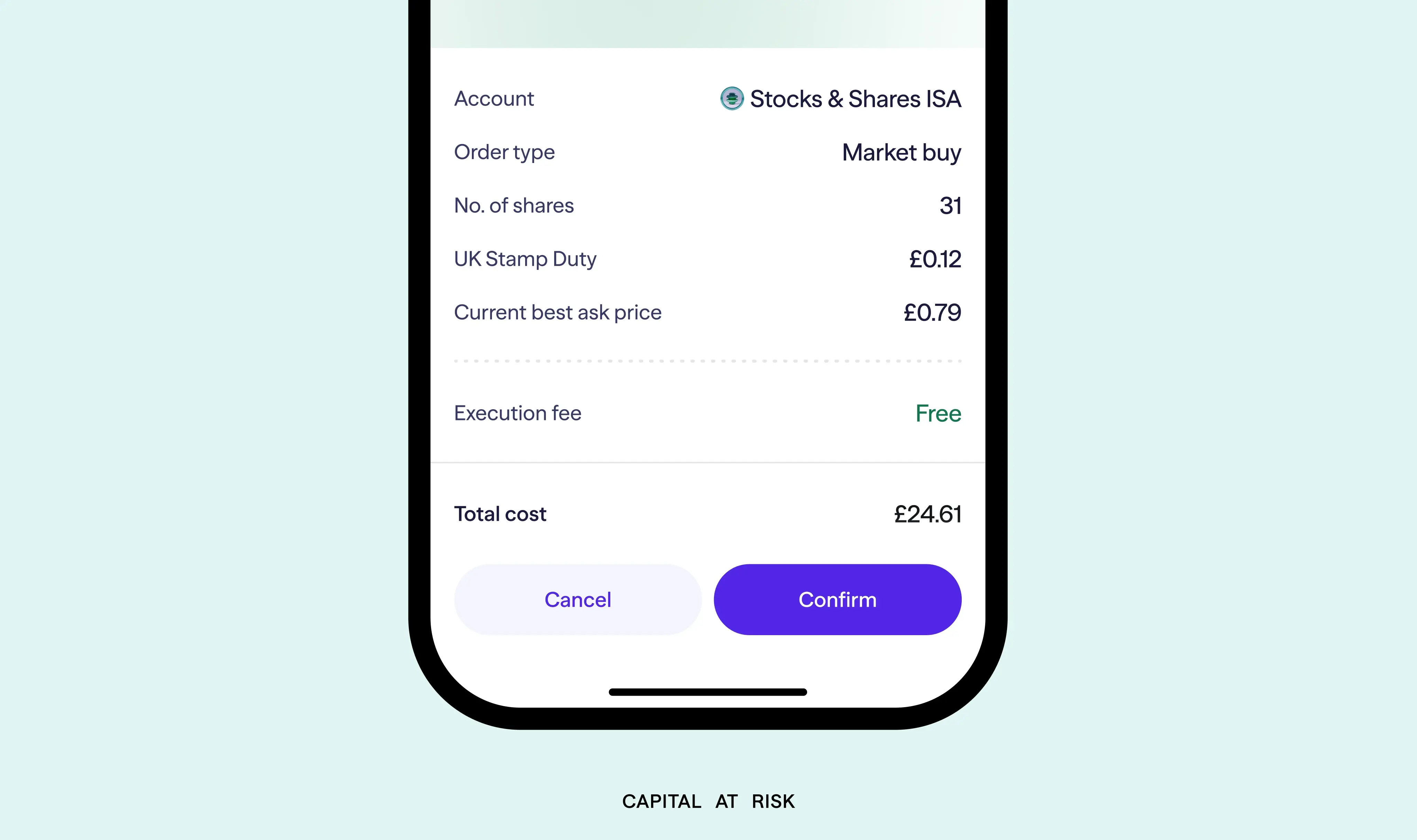

We’ve got some big news, and it’s a pricing update you’re going to love. Lightyear’s Stocks & Shares ISA is going commission-free. From today, there will be no more £/€/$1 per trade.

Why now?

It’s an important time for UK investors. Last month, the UK Government unveiled the Leeds Reforms: a set of measures to encourage long-term retail investing and help people make the most of high-yield equities. We’re fully on board with this mission.

Even though the anticipated changes to the ISAs didn’t (yet) materialise, we wanted to make a change of our own that removed even more barriers to entry and make it easier to get started in building future wealth.

The tide is turning

According to our research, the value held in UK Stocks and Shares ISAs and personal equity plans has surged 94% in the last decade — from £222 billion in 2012/13 to nearly £430 billion in 2022/23.

People are starting to invest more, and this is momentum that every investment platform has to build on. It’s our job to make sure that the products on the market are the best-priced they can be, with a delightful customer experience, so investing doesn’t remain a thing that only a small percentage of people actually do.

Building future wealth is not a nice to have. It’s a necessity. The UK has been dominated by legacy platforms charging high, hidden, or confusing fees for too long. We’re changing that.

Already low-cost, now even better

When we first launched our ISA earlier this year, it was already ten times cheaper than the market average (thanks to having no account, subscription, custody, or withdrawal fees).

Now, with commission fees gone too, you can invest more of your money into the market - and keep more of what you earn.

This move is so much more than just bringing down costs. It’s about reshaping the industry so that S&S ISAs work in the best interests of the end customer, not just the provider itself. As we like to say, for Lightyear to be successful in decades to come, our customers have to start being successful now.

The bigger picture

In July, we closed a $23M Series B to drive more retail investing in the UK, alongside launching AI-powered tools that put market intelligence, expert analysis, and relevant financial news at your fingertips.

These are just the first of many exciting updates to our UK business, and we can’t wait to share more over the coming weeks and months.

_Commission fees refer to trading (order) fees. Other fees such as FX and fund manager fees may still apply. And remember that when you invest, your capital is at risk. _