75% of businesses’ cash only earns an average of 1.61% interest

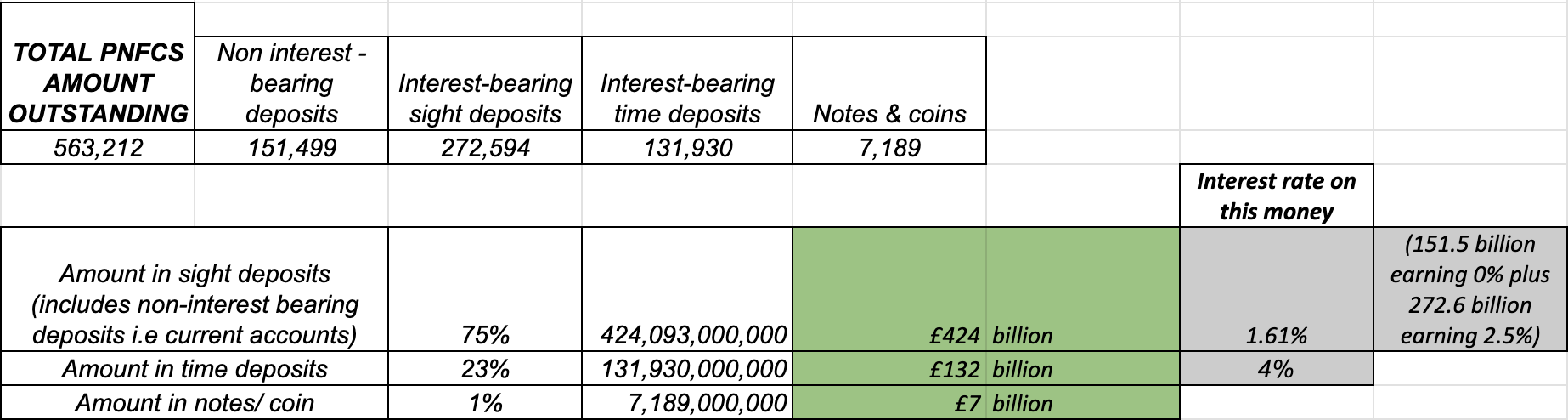

Bank of England’s deposit and interest rate data shows that 75% of businesses’ cash - that’s £424 billion - sits in savings or current accounts earning an average interest rate of 1.61%,1 despite the Bank of England base rate being 4.25%.

This number indicates that businesses either aren’t looking around for deals that provide a better return on their money, or that there aren’t enough providers offering better.

Access to investment accounts is a must for businesses

It’s crucial for businesses to be smart with their capital — and making sure inflation isn’t eating up savings is a huge part of that. Businesses need to park their cash where it’s generating returns, but remains easily accessible, so they can jump on opportunities to grow and maintain positive cash flow.

Today, that’s hardly possible. Business accounts with high street banks are hard to get and pay out little-to-no interest. If smaller businesses can get access, they often must go through a long, arduous process to access the stock market.

Other recently available options in the more innovative fintech sector often still don't allow certain types of businesses (SMEs in particular) to open accounts. And if they do, they come with stringent deposit criteria, high fees, and uncompetitive or non-existent interest offerings. Any interest-earning products on the market for businesses often lock in rates and add a plethora of service fees on top, ultimately reducing the value that’s passed back to the customer.

Lightyear is changing all that for businesses

Lightyear’s business accounts help SMEs in the UK make the most of their company funds, ensuring that excess corporate cash isn’t eaten up by inflation while sitting in bank current accounts. Our FCA regulated business investment accounts come with fast & automated onboarding and access to BlackRock’s Money Market Funds, earning you up to 4.40% gross yield.

Money Market Funds (MMFs) are highly liquid and low risk mutual funds, earning you daily interest, paid out every month. Available in three currencies, MMFs are benchmarked against the Central Banks’ overnight interest rate, giving you a rate slightly higher than what you’d get on cash — a privilege usually reserved for companies with millions to invest.

As of 4.06.2025, MMFs offer 4.39% on GBP, 4.33% on USD and 2.24% on EUR.

Businesses of all sizes can access our treasury product, with no minimum or maximum deposit, no account management fees and low, transparent pricing. For the GBP Money Market Fund, there’s no fee from Lightyear — while a 0.1% BlackRock fund fee applies.

As well as providing interest via money market funds and on uninvested cash, on the investing side Lightyear will give businesses access to 5,000+ international stocks and ETFs.

Disclaimer

Footnotes:

- Lightyear’s analysis of the Bank of England’s deposit and interest rate data.