Are you “good with money”? Or does the idea of taxes, ISAs and stocks make your head hurt? It’s easy to think that having more money would solve all your financial problems – but the answer may not be the amount of money you earn, but what you do with it. Being financially literate includes having the skills, attitude and awareness of financial concepts to help you maximise and protect your money.

But how financially literate is the general population? We tested the knowledge of 1,050 British adults by asking a series of questions covering themes of saving, investing, pensions and general financial knowledge to find out.

Key findings

- The majority (83%) of Brits underestimated how much annual income is recommended for a single pensioner living a moderate lifestyle (by at least £10,000)

- 74% of people think that school didn’t prepare them for financial responsibility as an adult

- Gender investment gap: 41% of men could correctly identify the difference in risk between stocks and bonds compared to 33% of women

- The average person rated themselves as a confident 7 out of 10 when dealing with money

- 89% of people consume books, listen to podcasts or research financial related topics, to improve their financial literacy

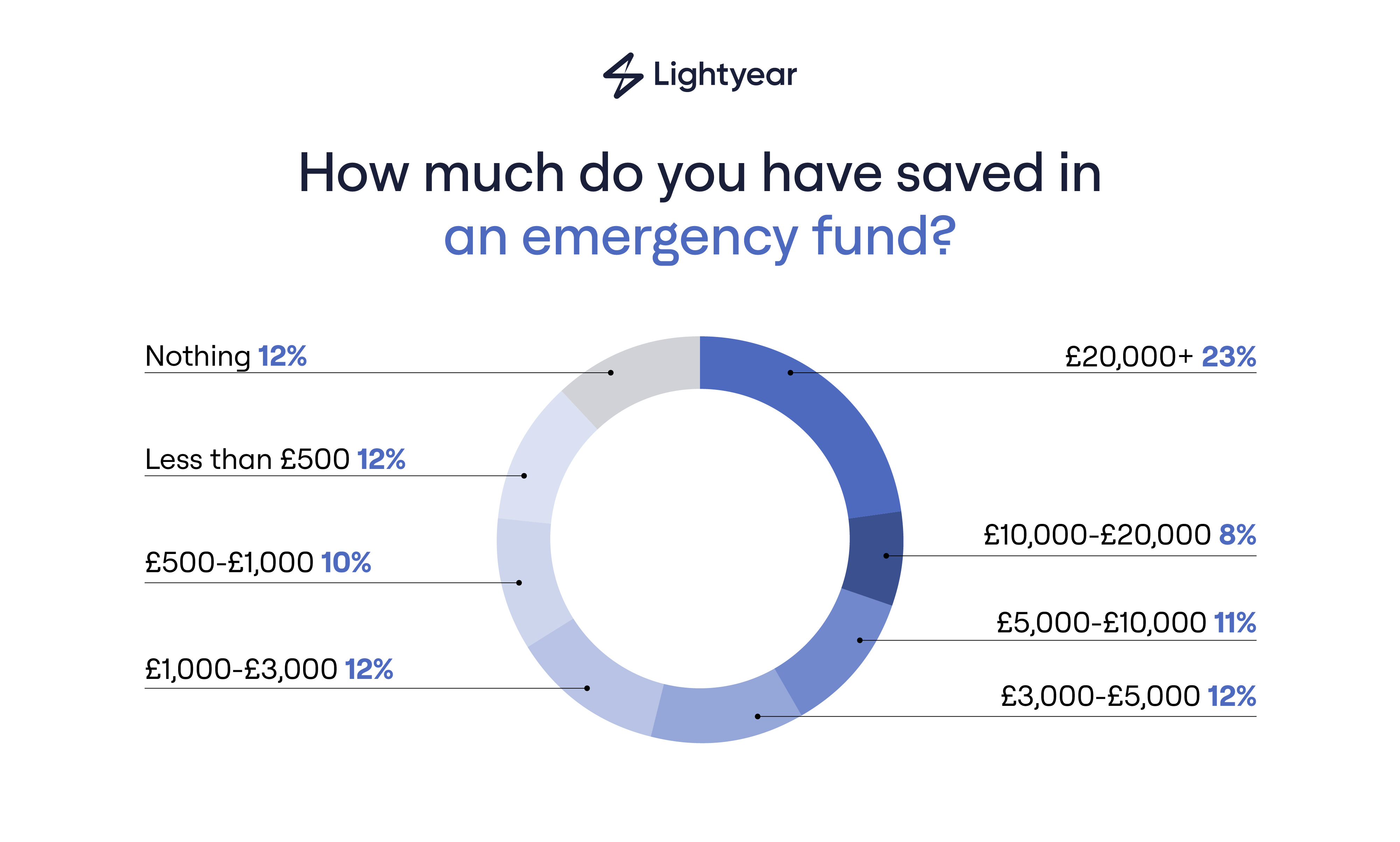

- Almost one in four (23%) have less than £500 saved ready for emergencies

Overall, the majority of respondents were able to correctly answer six of the 10 questions in the study. The four questions which the majority of respondents failed to answer correctly were two questions about pensions, one question about investments, and one question about the British fiscal year.

Which multiple choice questions did respondents guess correctly?

You'll find the correct answers at the end!

| Difficulty | Question | % Correct |

| Easy | What is inflation? | 85% |

| What is an ISA? | 81% | |

| What is an emergency fund? | 72% | |

| Medium | What is the tax-free ISA allowance per year? | 70% |

| What is compound interest? | 68% | |

| What is the full rate of the new State Pension per week? | 64% | |

| Hard | At what age can you currently access your State Pension in the UK? | 48% |

| When does the British fiscal year run from? | 46% | |

| Identify a false statement about stocks and bonds (see list at the end) | 38% | |

| According to The Pensions and Lifetime Savings Association (PLSA), what is a moderate annual income for a single pensioner? | 11% |

The study also revealed that most people have big gaps in their financial literacy. For example you may feel confident about saving practices, but not know about how inflation works. Only 1% of respondents were able to answer every single question correctly.

74% of respondents said that their schooling did not prepare them enough to navigate the financial world as adult

Despite just a few being able to correctly answer all the questions, when asked to rate how confident they felt handling money out of 10, with 10 being the most confident, the average person said they were a 7 out of 10. But this confidence doesn’t seem to convert into real, practical knowledge.

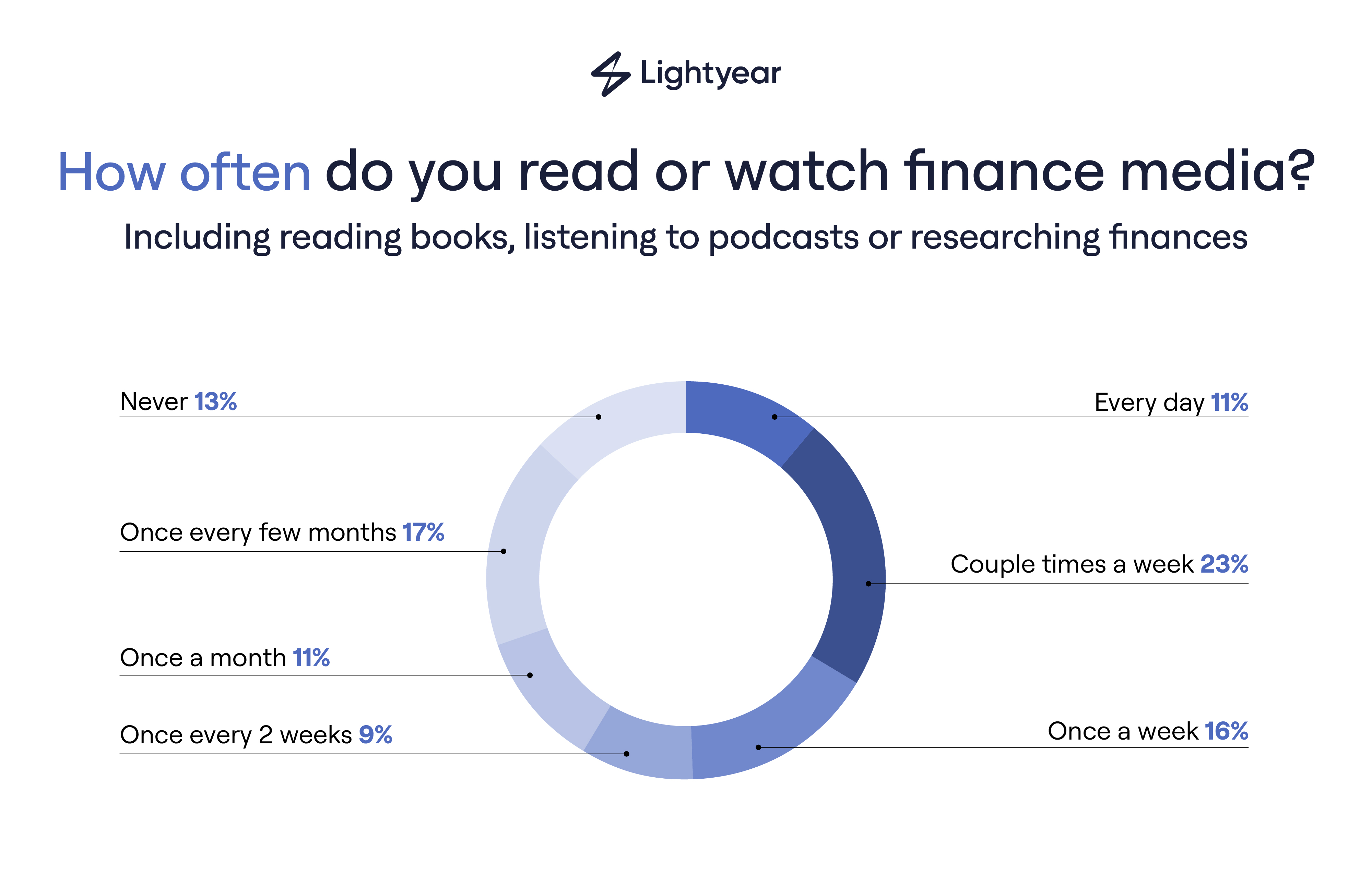

Being proactive about your financial knowledge makes a big difference. Those who answered all the questions correctly said they consume books, listen to podcasts or research money related topics in their spare time. But how often does the average person take the time to inform themselves about finances? And does the British schooling system do enough to prepare people for their adult financial responsibilities?

A vast majority (87% of respondents) said that they consume financial related content in their spare time, which perhaps explains why so many respondents felt confident handling their money. Activities might include reading a personal finance book, listening to a podcast, watching the stock market or consuming financial information on TikTok or social media.

And education pays off: only 8% of those earning more than £100,000 per year never consumed financial-related content, compared to 22% of those earning less than £25,000.

But if the majority of people are informing themselves about personal finance in their spare time, and feel confident handling their money, how come so many people are unable to answer all the financial questions correctly?

‘Finfluencers’ (financial influencers) who share content offering financial advice and tips attract billions of viewers and subscribers. For example, the TikTok hashtag #FinTok has garnered more than 4.7 billion views. Unfortunately, not all financial advice you find online is valuable. Some of these so-called ‘financial gurus’ are unaccredited and may even profit from misleading people. You may also be more likely to consume information about trending financial topics or ‘get rich quick’ schemes – without learning the basic fundamentals like ISAs or how interest works.

The place where you should expect to learn these fundamentals is school. It’s not surprising that so many British adults have turned to podcasts, books and other personal finance content to learn about money considering that 74% of respondents said that their schooling did not prepare them enough to navigate the financial world as adults.

The top five incorrectly answered questions

1. According to The Pensions and Lifetime Savings Association (PLSA), what is a moderate annual income for a single pensioner?

Although 74% of UK adults have a private pension, according to the most recent statistics released by Gov.uk, the number of members making individual contributions to a personal pension decreased to 6.8 million in 2022 to 2023 from 7.4 million in 2021 to 2022.

How much you should save for your retirement years depends on the type of lifestyle you want to maintain, but as a guideline, the Pensions and Lifetime Savings Association (PLSA) calculated how much pensioners need to maintain a minimum, moderate and comfortable lifestyle.

When we asked respondents to guess how much a moderate standard for a single pensioner was, the majority (83%) underestimated the cost by at least £10,000 a year. Only 11% correctly guessed that to maintain a moderate lifestyle (which allows for a car and one two-week foreign holiday a year) a single pensioner needs to budget £31,300 per year after tax.

If a full state pension is received, this means that the average single pensioner needs to save around £555,000 for their retirement.

Interestingly, those over 60 were slightly more likely to incorrectly guess the answer – and more likely to opt for the smallest amount (£12,400 per year) than younger participants (31% compared to 22%).

| Answer | Percentage of respondents | Percentage of 60+ respondents |

| £12,400 a year for a moderate income in retirement. | 22% | 31% |

| £15,900 a year for a moderate income in retirement. | 27% | 23% |

| £21,000 a year for a moderate income in retirement. | 34% | 32% |

| £31,300 a year for a moderate income in retirement. | 11% | 9% |

| £35,000 a year for a moderate income in retirement. | 6% | 5% |

2. Which of the following statements is false about stocks and bonds?

According to a report by Finder in 2024 an estimated 23% of the population actively invested in the stock market. There is also a large gender disparity when it comes to investing. One survey found that women were 18% less likely to invest in stocks and shares than men. One reason given was that 52% of women said they felt they did not know enough about online trading and investing.

So how knowledgeable are Brits about stocks and bonds, and is there a gender knowledge-gap? Although 38% of our respondents did identify the false statement about stocks and bonds in the list, this was still the 2nd most incorrectly answered question in the survey.

There was a significant knowledge gap between men and women. 41% of men correctly answered this question compared to 33% of women. However, for women wanting to get into investment but unsure where to start, there are resources online specifically designed to empower women investors and close the gender disparity.

| Answer | Percentage of respondents |

| Bond prices are affected by changes in interest rates, inflation, and credit ratings of the issuer. | 13% |

| Bonds typically pay a low rate of return, while returns associated with stocks can be higher. | 16% |

| Stock prices are influenced by factors such as company earnings, market sentiment, and economic conditions. | 16% |

| Stocks are ownership shares in a company, while bonds are a kind of loan from investors to a company or government. | 17% |

| Stocks tend to be safer investments because they fluctuate less than bonds over time. | 38% |

3. When does the British fiscal year run from?

The tax year runs very differently in the UK than other countries around the world – but do you know when it is? Only 46% of respondents knew that the tax year runs from April 6th to April 5th. Getting these dates wrong could create huge financial risks for self-employed people and business owners.

But why does the fiscal year start at such a strange point in the year? The reason is long-winded and historical. Until the mid 18th century, the new year (and financial year) started on the 25th March. When the Gregorian calendar (what we use today) was adopted there was an 11 day discrepancy and so the fiscal year was moved to April 5th.

| Answer | Percentage of respondents |

| April 1st to March 31st. | 42% |

| April 6th to April 5th. | 26% |

| Changes every year. | 5% |

| January 1st to December 31st. | 6% |

| September 1st to August 31st. | <1% |

4. At what age can you currently access your State Pension in the UK?

The topic of pensions comes up again in the list of most incorrectly answered questions. This time 52% of respondents incorrectly guessed the correct age you can collect your state pension. However, those aged 60+ were 24% more likely to correctly guess that the state pension age is 66 (72%).

The age you can collect your pension is adjusted to life expectancy, and before the Pensions Act of 1995 the state pension had been 60 for women and 65 for men. At the time of writing (January 2025) the state pension age is 66 – a figure that 48% of respondents guessed correctly. However, the pension age is gradually being raised to 68 by 2046, so this figure is not static.

| Answer | Percentage of respondents | Percentage of 60+ respondents |

| 50 | 1% | 0% |

| 60 | 5% | 2% |

| 65 | 24% | 8% |

| 66 | 48% | 72% |

| 68 | 21% | 18% |

5. What is the full rate of the new State Pension per week?

Completing the top five most incorrectly answered questions is another pension question – meaning that 3 of the top 5 incorrectly answered questions were on this theme. Although the majority of people (64%) correctly guessed that the state pension is £221.20, 19% of people overestimated the weekly allowance, and 18% of people underestimated the allowance.

Again, those aged over 60 were more likely to correctly guess this answer. Four in five (79%) of those aged 60+ correctly answered that the rate of the full state pension is £221.20.

Again, like the pension age, the rate of the State Pension is frequently adjusted to consider the changing cost of living. It’s also important to know that you may get more or less depending on your National Insurance (NI) record – and usually you need more than 10 years of NI contributions to be eligible for the State Pension at all.

| Answer | Percentage of respondents | Percentage of 60+ respondents |

| £150.50 | 18% | 9% |

| £221.20 | 64% | 79% |

| £250.00 | 12% | 5% |

| £375.60 | 5% | 5% |

| £380.00 | 2% | 2% |

The average respondent has £8,549 set aside for emergencies

Most respondents (72%) correctly knew that an emergency fund is an accessible savings account with money set aside and only used in case of unplanned events. The most common incorrect answer (17%) was that an emergency fund is the money set aside by the government in case of an unforeseen crisis (like the COVID-19 pandemic) – a possible confusion with BBL (Bounceback loans).

| Answer | Percentage of respondents |

| A government fund to help support people who have filed for bankruptcy. | 6% |

| A high-risk investment account designed to grow your wealth quickly in case of emergencies. | 1% |

| An accessible savings account with money set aside and only used in case of unplanned events. | 72% |

| An emergency fund is a credit card you use exclusively for unexpected expenses. | 5% |

| The money set aside by the government in case of an unforeseen crisis e.g. the COVID-19 pandemic. | 17% |

We also asked respondents if they had an emergency fund and if so, how much they had in it. The good news is that a vast majority (88%) of respondents have an emergency fund. One in ten people (12%) said that they didn’t have an emergency fund at all, but 30% of people said they have more than £10,000 set aside.

It’s recommended that people have between three and six months worth of essential outgoings (like rent or mortgage, food and bills). Taking an average of all answers, the study average amount that people had in savings was £8,549.

Methodology

The survey was conducted in December 2024 via survey platform Pollfish. A total of 1,050 British adults were surveyed about their confidence with money, what financial informational resources they engage with, and the money they had set aside for emergencies. They were then asked 10 questions to test their financial literacy across subjects like investments, savings, pensions and taxes.

The sources for the questions - and correct answers - are listed below and correct as of January 2025:

| Question | Correct Answer | % Correct |

| 1. What is inflation? | Inflation is the rising price of goods and services associated with the cost of living. See ONS. | 85% |

| 2. What is an ISA? | An ISA is a tax-free savings or investment account. See Gov.uk. | 81% |

| 3. What is an emergency fund? | An accessible savings account with money set aside and only used in case of unplanned events. See Lloyds Bank. | 72% |

| 4. What is the tax-free ISA allowance per year? | £20,000. See Gov.uk. | 70% |

| 5. What is compound interest? | Compound interest is the interest calculated on the initial investment or loan and also on the accumulated interest from previous periods. See Investopedia. | 68% |

| 6. What is the full rate of the new State Pension per week? | £221.20. See Gov.uk. | 64% |

| 7. At what age can you currently access your State Pension in the UK? | 66. See Age UK. | 48% |

| 8. When does the British fiscal year run from? | April 6th to April 5th. See Gov.uk. | 46% |

| 9. Identify a false statement about stocks and bonds* | Incorrect: stocks tend to be safer investments because they fluctuate less than bonds over time. See Investopedia. | 38% |

| 10. According to The Pensions and Lifetime Savings Association (PLSA), what is a moderate annual income for a single pensioner? | £31,300 a year for a moderate income in retirement. See PLSA. | 11% |

*The full list of statements for question 9 are listed below. The final statement is the incorrect answer:

- Bond prices are affected by changes in interest rates, inflation, and credit ratings of the issuer.

- Bonds typically pay a low rate of return, while returns associated with stocks can be higher.

- Stock prices are influenced by factors such as company earnings, market sentiment, and economic conditions.

- Stocks are ownership shares in a company, while bonds are a kind of loan from investors to a company or government.

- Stocks tend to be safer investments because they fluctuate less than bonds over time.

The demographics of the respondents were:

Gender: Female 43%, Male 57%

Age:

- 18 - 43: 26%

- 44 - 59: 35%

- 60+ : 39%

UK region:

- South of England 43%

- North of England 43%

- Wales 5%

- Scotland 8%

- Northern Ireland 1%

- Unknown <1%

Sources

The sources used in the article are:

- Moneymarketing, “Leader: FCA to rein in ‘finfluencers’ on social media. Will it be thumbs up or thumbs down?”,2024

- Finextra, “UK government urged to implement compulsory financial education from primary school”, 2024

- Financial Conduct Authority, “Financial Lives 2020 survey: the impact of coronavirus”, 2021

- GOV.UK, “Private pension statistics commentary: July 2024”, 2024

- Standard Life, “Cost of being single in retirement: £277.5k”, 2024

- Unbiased, “Investment statistics in the UK: a comprehensive overview”, 2024

- Reuters, “Closing the gender investment gap: Why women typically trade less than men – and why that may be changing”

- Forbes, “17 Fintech Apps Created By Women, For Women”, 2024

- Taxback.com, “Why does the UK tax year start on 6 April?”, 2024

- House of Commons Library, “State Pension age review”, 2023

- GOV.UK, “The new State Pension”

- AgeUK, “The new State Pension”