Running for the Hills

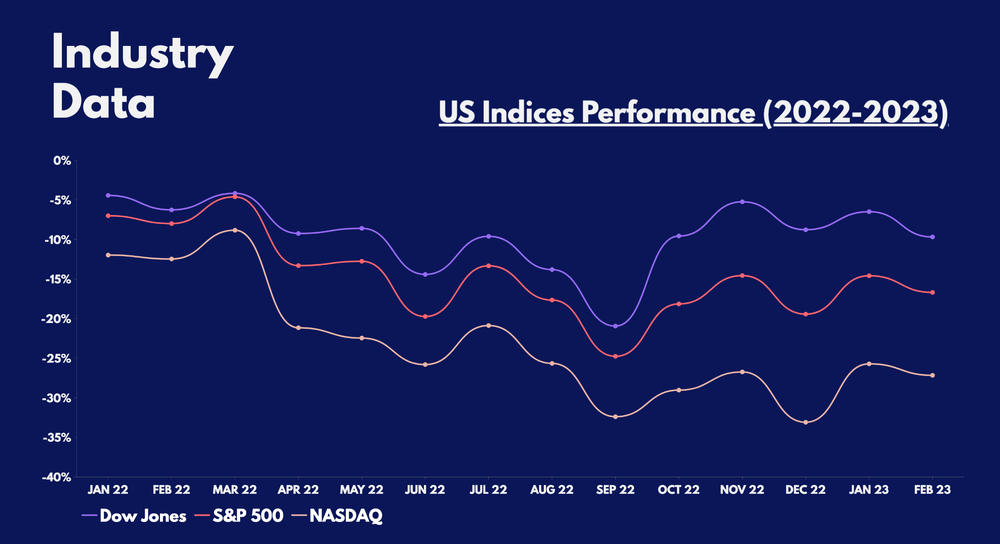

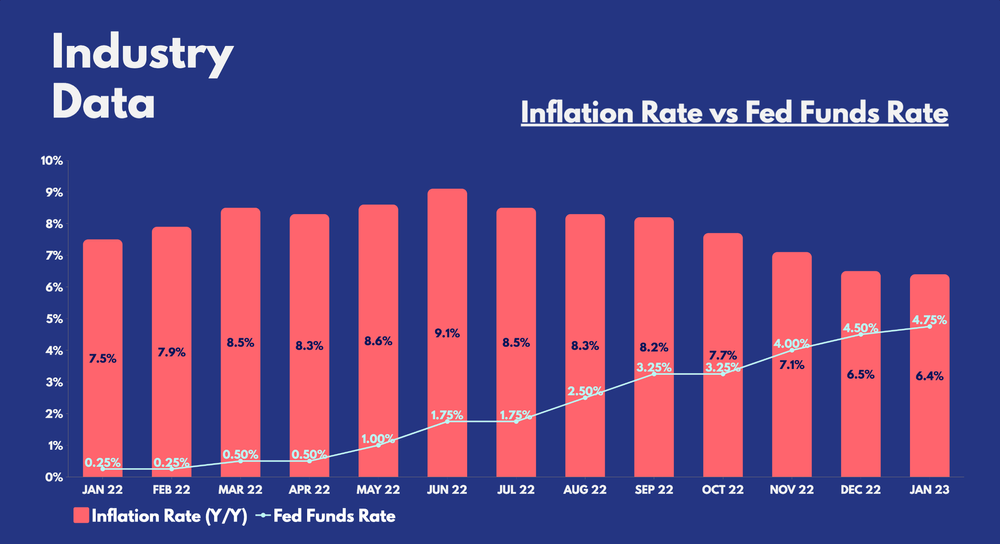

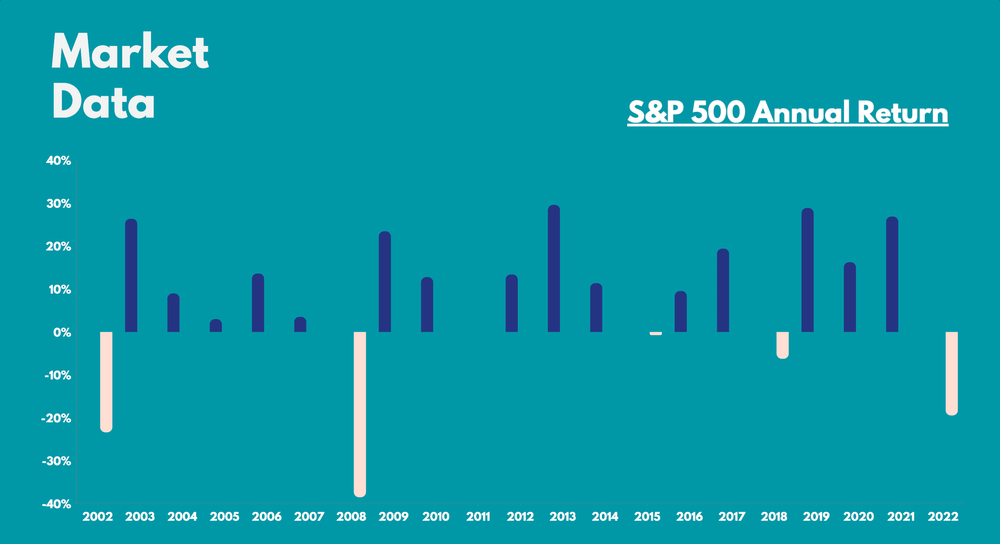

2022 was a year where investors were left running for the hills. The torrid combination of sky-high inflation and accelerated rate hikes resulted in an all-out capitulation of the stock market. Consequently, all three of the US’ main indices declined substantially and are now way off their all-time highs.

The monumental drop in equities can be attributed to various reasons. However, there are two very compelling reasons. The first being that higher inflation eats into the spending power of the consumer. The second would be that higher interest rates would discourage borrowing. Companies would then see lower sales and profits, and hence, lower valuations.

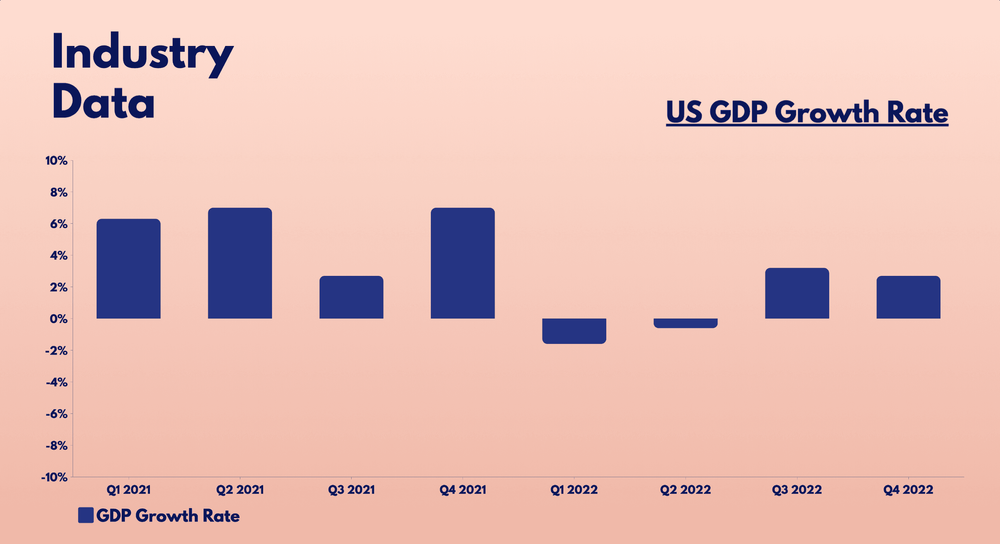

In fear of this, fund managers and investors sold their positions and opted to hold cash instead as fears of a recession lingered on Wall Street. Economic data across the board showed plenty of weakness in 2022, with the US even entering a technical recession, when its GDP showed two consecutive quarters of contraction in Q1 and Q2 last year.

Hitting Rock Bottom

Nonetheless, there are numerous arguments that point towards the stock market having found a bottom, and that it could be set for a rebound in 2023.

For one, since 1950, the average bear market has lasted about 342 days. And currently, the S&P 500 is well past its average bear market cycle. In fact, the index has recovered by 10% since bottoming out in October.

More interestingly, because stocks and shares trade on speculation and future projections, it’s got quite a solid track record of rebounding before or during a recession. This rebound usually starts about 3 to 6 months before the end of a recession, with the past five recessions proving this trend:

- July 1981 to November 1982: Stock market bottomed in August 1982.

- July 1990 to March 1991: Stock market bottomed in October 1990.

- March 2001 to November 2001: Stock market bottomed in September 2001.

- December 2007 to June 2009: Stock market bottomed in March 2009.

- February 2020 to April 2020: Stock market bottomed in March 2020.

It’s also worth noting that the market has a tendency to start rebounding 6 to 12 months before earnings estimates trough. Currently, earnings estimates for the S&P 500 are expected to bottom in Q1 2023. So, a rebound may already be in motion.

Nevertheless, the most prominent case that the bottom is in would be that headline inflation is finally coming down. Energy prices have now hit one-year lows, with goods prices also seeing disinflation.

A Bumpy Run

That being said, the rebound isn’t going to be as smooth as January’s stellar performance, with February giving investors a firm reminder that inflation is still more than three times above the central bank’s target of 2%.

What’s more, the path back down for inflation isn’t going to be easy either, as it remains sticky in certain areas -- particularly services and rents. And with real wages creeping up towards inflation, this could exacerbate a wage-price spiral, entrenching high levels of inflation into the economy. As a result, the Federal Reserve may have to hike rates to a higher level than the market is currently pricing in.

Therefore, those hoping for a ‘no landing’ scenario will have to come to terms with higher rates for longer. The Fed is adamant on putting the brakes on the economy sooner, or risk high inflation doing an insurmountable amount of damage to the economy.

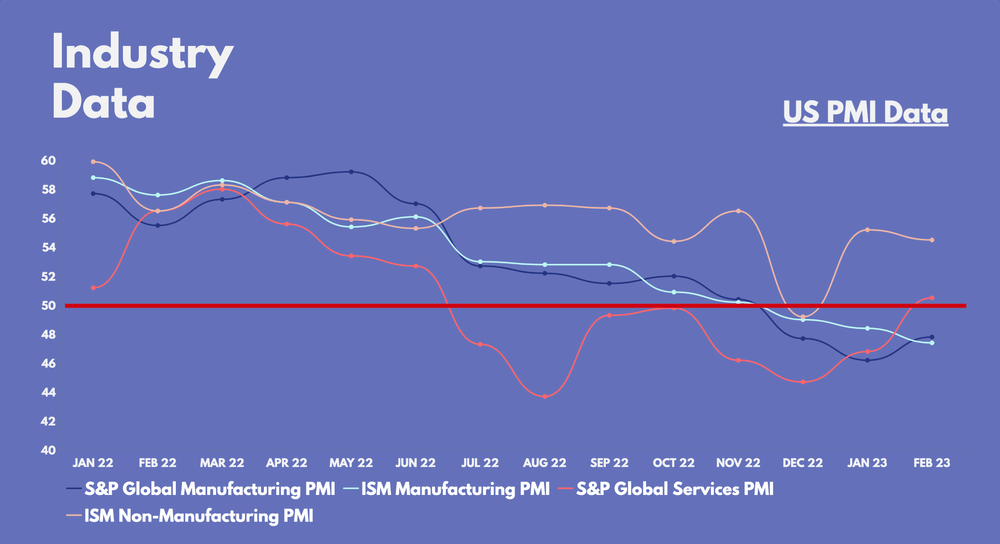

And given the recent economic data, it’s fair to say that the Fed isn’t looking to pause its rate-hiking cycle anytime soon. Strong Purchasing Managers Index (PMI) data paired with a hot labour market are only going to push inflation even higher and that’s not what Fed Chair Jerome Powell wants. Thus, any recovery in equities is going to be a bumpy one.

Time vs Timing

Whatever the outcome may be in 2023 and onwards, investors should always remember this -- time in the market always beats timing the market. History shows that timing the market is never a perfect strategy, and attempting to do so often means missing out on the stock market’s best days.

As such, staying in the market and dollar-cost averaging during pullbacks could be a great way to navigate the stock market during volatile times. After all, Warren Buffett has always said, "Be fearful when others are greedy and greedy when others are fearful”.

Don’t Just Charge Ahead

Having said all that, it should be noted that when it comes to buying stocks and shares, it shouldn’t be done blindly. It’s always crucial to understand a company, its investment case, and whether the drop in its share price is worth buying into. Make sure to consider a firm’s financials, prospects, management team, valuation, industry, and other aspects, before investing.

Investing is a long-term activity. The stock market is a risky and volatile place to put money into, but given enough time, data shows that it can be worth it in the long run. After all, history is on the investor’s side, with bull markets always triumphing over bear markets. And with that in mind, there’s no better place to start investing than with Lightyear.

Disclaimer

When investing, please remember that your capital is at risk. Past performance is not an indicator of future success. Terms apply, seek guidance if necessary.