Risky Treasure

Banking is a lucrative business, and its business model isn’t too difficult to grasp. Customers deposit their money into banks. Then, bankers can either store that cash or choose to invest a portion of those funds in financial instruments. These include stocks, bonds, mortgage backed securities, and many more. The bank then makes a profit from those instruments.

This business model works, but it’s also risky. Bankers are notorious for getting too greedy and end up gambling away customers’ funds to buy risky assets promising high returns, only for them to drop to zero. This is after all, what caused the great financial crisis (GFC).

Nonetheless, that didn’t stop SVB from investing the majority of their clients’ money in long-duration US government bonds (treasuries). This move is theoretically safe as US treasuries are one of the safest securities to invest in -- only this time, it wasn’t.

Smash and Grab

Long-dated US treasuries, like the 30-year bills which SVB were planning to hold until maturity are extremely sensitive to interest rates. Therefore, they lost a chunk of their value when the Fed aggressively raised rates throughout 2022. This meant that the better part of SVB’s assets had depreciated tremendously and were sitting on unrealised losses. Those big losses were then realised when the company was forced to sell those bonds in order to repay their customers, as they rushed to withdraw funds en masse. This is known as a bank run. Normally, this wouldn’t present an issue because there are regulations in place to ensure that banks have enough liquidity. Unfortunately for SVB though, it had three major problems:

- SVB was otherwise known as a Category IV organisation (less than $250bn in consolidated assets). This means that they’re not obliged to abide by the SEC’s rules to possess or disclose its liquidity coverage ratio, making them more susceptible to a liquidity crisis.

- The bulk of SVB’s clients were commercial businesses. Consequently, a bank run sucked more liquidity out from the firm at a much quicker pace.

- The FDIC (at that time) only insured deposits of up to $250,000. Hence, commercial clients who normally have more than the insured amount, were incentivised to withdraw their funds when they heard about a bank run unfolding.

In an attempt to circumvent the situation, the board proposed to raise capital via equity. Unsurprisingly, this didn’t have the desired effect. Instead, it further spooked investors and customers to accelerate withdrawals, liquidating SVB into bankruptcy.

By Monday, the US government, Federal Reserve, and US Treasury released a joint statement to assure customers that all funds deposited with SVB would be fully insured. However, this didn’t stop the market from reacting to contagion fears as shares of other banks like Signature, First Republic, and Credit Suisse tumbled massively.

Doing Due Diligence

So, it should go without saying that investing in banks can be an extremely risky move as they can very easily go under in the blink of an eye. For that reason, it’s crucial to assess the risks associated with a bank before buying their stock. Here are a number of indicators to look for to assess a bank’s financial footing:

- Asset Quality Ratio (AQR) - Measures the percentage of non-performing loans (NPLs) in a bank's loan portfolio compared to total loans. A high AQR ratio could mean higher impairment charges (defaults), and could impact the bank’s balance sheet and profits.

- CET1 Ratio - Looks at a bank's capital adequacy and ability to absorb losses. It measures the proportion of a bank's risk-weighted assets supported by CET1 capital (the highest-quality capital a bank holds). Banks are regulated to hold a minimum CET1 ratio of 4.5%, though this might be higher, depending on the size of the bank.

- Loan-to-Value Ratio (LTV) - Assesses the risk of loans and the borrowers’ ability to repay it. The lower the LTV ratio, the less risky loans are for the lender, because the assets being used as collateral are more valuable than the loans.

- Tangible Net Asset Value (TNAV) - To determine the value of a company's tangible assets (buildings, equipment, inventory) minus liabilities. The higher the TNAV, the stronger the balance sheet.

- Liquidity Coverage Ratio (LCR) - Ascertains a bank's ability to meet short-term obligations with high-quality liquid assets in the event of a bank run. The higher the ratio, the lower the chance for a liquidity crisis to unfold.

Stressful Times Call for Stringent Measures

Having said that, sometimes those measures aren’t definitively going to prevent a bank from collapsing either. Unrealised losses from high-quality assets like government bonds may be included in these ratios, and paint an inaccurate number.

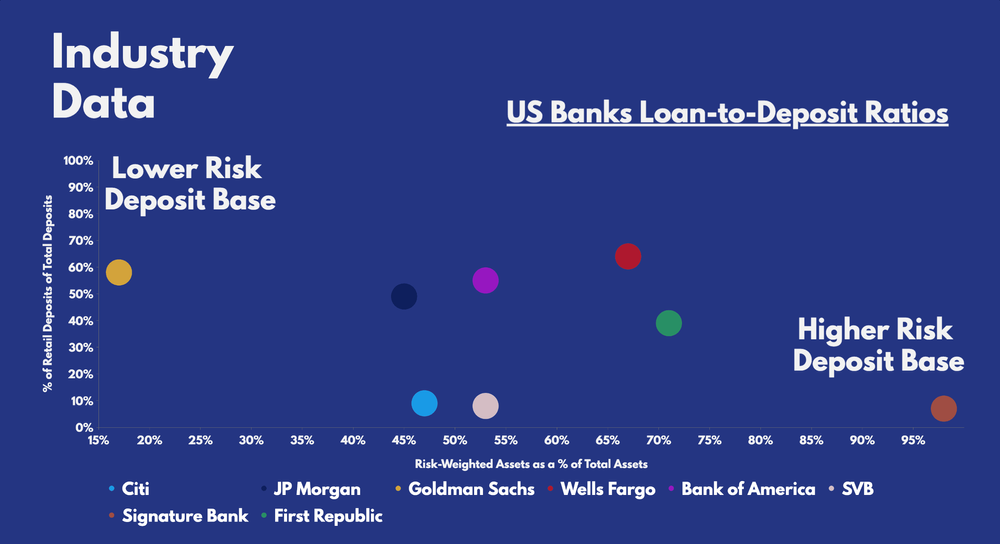

Thus, other stress tests can be carried out on banks to determine how rigid their financials are. For instance, one could look at the percentage of risk-weighted assets (RWA) a bank has in relation to its total asset pool. And if treasuries are to be accounted for, then a deep dive into the percentage of hold-to-maturity bonds to a bank’s assets may be worth considering too.

Data source: Citi, JP Morgan, Goldman Sachs, Wells Fargo, Bank of America, Silicon Valley Bank, Signature Bank, First Republic Bank

Banking on Hope

Ultimately, the safety of a bank will always be at the discretion of the Federal Reserve, but more crucially, its customers. The banking industry remains fragile and any hint of bad news is bound to send shockwaves over the next few weeks. Further rate hikes from the Fed are only going to push more banks into dangerous territory, which could jeopardise the entire banking system.

Given the risks associated with such an event, the market is no longer expecting the Fed to raise rates at their next meeting. In fact, rates are expected to fall by 1.25% by the end of the year. This should ease the pressures on the industry, and could result in a rebound for many depressed bank stocks. This could present a buying opportunity for beaten-down names.

Nevertheless, it’ll be wise to proceed with caution. The US authorities have ensured the safety and reliability of its banking system. Even so, the FDIC only has so much in its pockets to bail other banks out before it empties itself out too. And in such an event, the consequences may be dire for those holding bank stocks. Whatever the outcome, all eyes will be on Jerome Powell and his next move.

Fortune may favour the brave, but sometimes the cake just isn’t worth the candle. And in SVB’s case, the cake was gone before shareholders even had the chance to blow the candle.

Disclaimer

When investing, please remember that your capital is at risk. Past performance is not an indicator of future success. Terms apply, seek guidance if necessary.