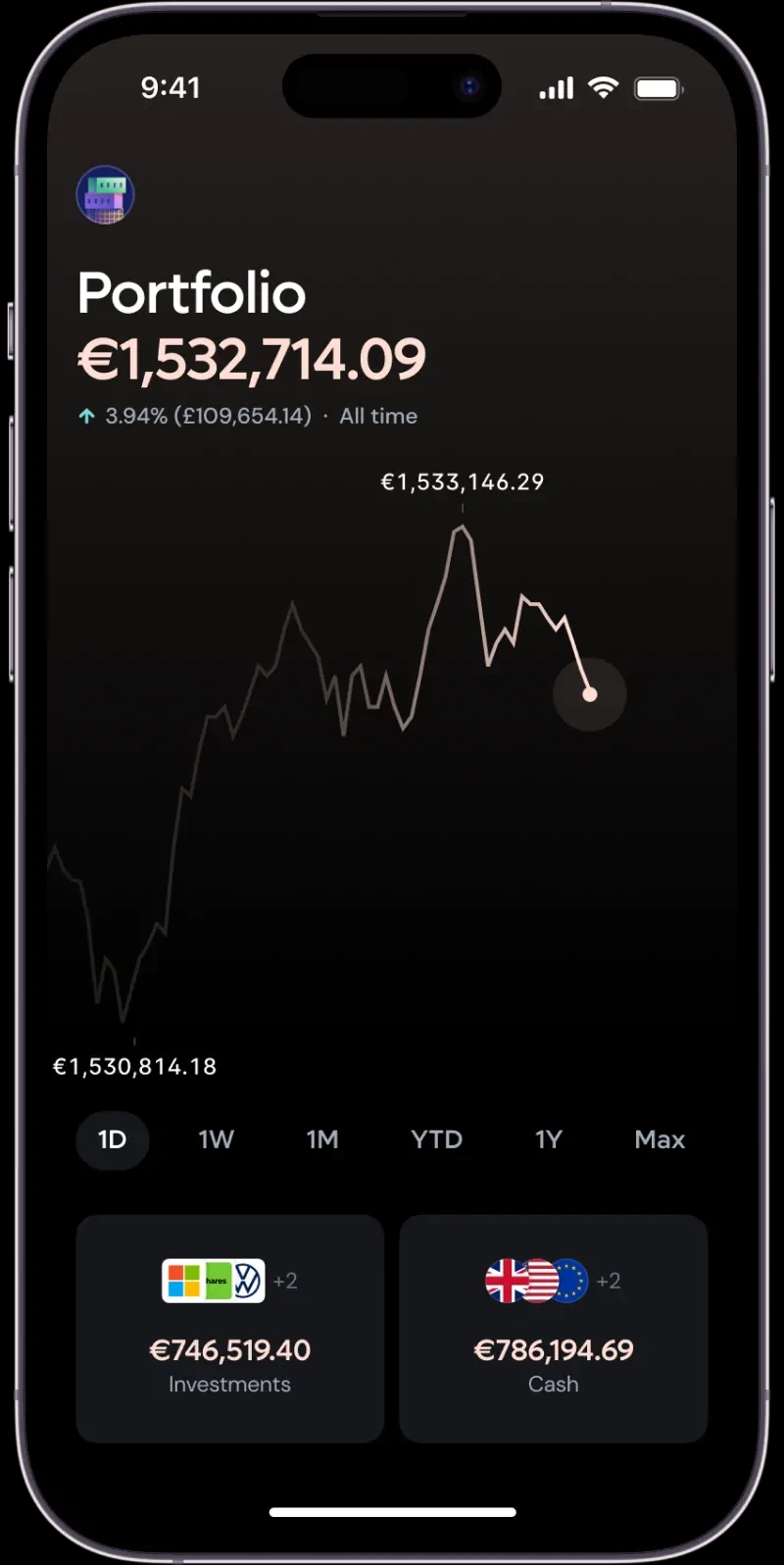

Put your fundraised

cash to work

Earn interest

4.84%

4.46%

2.99%

with Money market funds. All yields shown are gross and variable.

Tried and trusted by

1,000+

companies

3 reasons to put your cash into MMFs with Lightyear

Invest with low risk

When you deposit your money into Lightyear, it's segregated from firm assets at all times. If you choose to buy MMFs, we'll hold your money until the order is filled (max 24 hours) then it's sent to BlackRock. The MMFs are held according to the prospectus, by BlackRock depositary J.P. Morgan.

BlackRock funds are AAA rated - the highest possible rating – showing high level of creditworthiness and strong capacity to repay investors.

… and low pricing

Access your money, always

A million invested = a free employee

Say goodbye to high fees & locking away your money …

"Investing in money market funds is an important part of our treasury management strategy, especially today, with interest rates at a high standstill. BlackRock funds through Lightyear are the best option in the market for this.

At Ready Player Me we’re also using Lightyear to grow our money. There’s a few reasons for this choice: Lightyear offers highly liquid funds at a low cost, plus they’ve made opening and managing of business investment accounts easier than ever before."

Pavel Ruban, Ready Player Me

Combating treasury risks with MMFs

Submit interestCredit & concentration risk

Holding your money with weak counterparties or in one place.

The funds we offer have over 300 holdings. And by law, a single holding of an MMF can’t account to over 5% of all holdings — making MMFs a very diversified asset class.

Liquidity risk

Not being able to access your money in a short timeframe.

10% of an MMF has to - by law - be invested in daily maturing assets. For the funds we offer, between 20-50% of assets mature daily, ensuring fast payouts for you.

Interest rate risk

Losing money to fluctuating interest rates.

The longer the maturity of an instrument is, the more sensitive it is to interest rates changing. The weighted average maturity for underlying assets in the funds we offer is 56 days, keeping your interest rate risk low.

What are Money Market Funds?

Money market funds are interest paying instruments, investing in secure, highly liquid underlying assets like cash and cash equivalents.

These assets change with base interest rates – offering higher returns in today’s high interest environment – but have short maturity, meaning they’re less sensitive to short-term interest rate changes

MMFs aim to maintain a net asset value of $ / € / £ 1 per share. Excess earnings are generated through interest on the portfolio holdings, and distributed to you as monthly dividend payments.

Keeping your assets protected

Regulated in the EU & UK

Safeguarding your assets

Keeping your account safe

Questions you might ask

How do I open a business account?

How much does it cost to open a business account?

Which countries are money market funds available in on Lightyear for VC-backed businesses?

Currently, money market funds are available in the following countries:

Austria Estonia Finland France Germany Hungary Italy Luxembourg Netherlands Spain

Why do I need a Legal Entity Identifier (LEI)?

A Legal Entity Identifier, also known as an LEI, uniquely identifies your business. It's required by law for businesses trading stocks in Europe.

If you’ve already registered an LEI — we’ll find it for you during onboarding, all you need to do is confirm the details.

If you don’t yet have an LEI, you can generate one within the Lightyear app for €45 + VAT.

How often does the yield on money market funds change?

How often do money market funds pay interest?

MMFs available on Lightyear's platform accrue interest daily and we pay the returns to your account on the first of every month.

What are the benefits of money market funds, compared to fixed term deposits?

Fixed term deposits lock your money for a specific time, meaning there’s no liquidity for when you need your money fast. This usually means businesses structure their money into multiple tiers, allocating different amounts into. For example, 1 month / 2 months / 3 months / 6 months & 12 months deposits, which is a hassle to maintain.

Money market funds are required to maintain high liquidity — and with Lightyear, all trades placed before 9:30am Dublin time will be processed that day, with payouts no later than the following one.

Is there a minimum deposit size?

We offer a concierge service for VC-backed businesses investing in MMFs, for which the minimum deposit size is 500€/$/£. (For personal Lightyear MMF accounts it’s 1 €/$/£.)

Where can I find detailed information about the funds you offer?

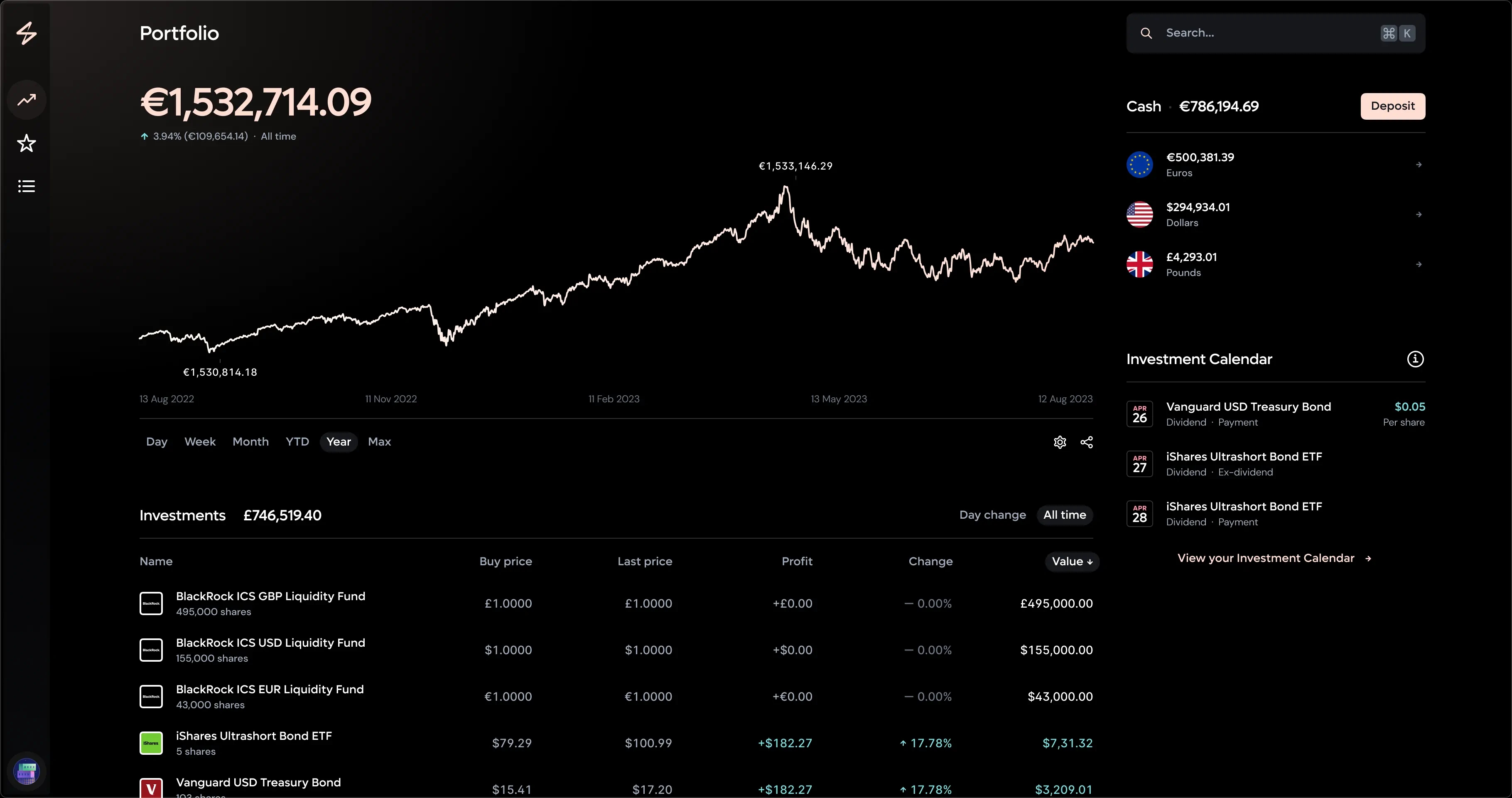

You can invest in three BlackRock Money Market Funds funds, in three currencies. The best part — when you invest in a fund in a currency you already have, there’ll be no currency conversion at play!

Here are the funds we offer on our platform: